There are a few companies that offer coupons and vouchers to their products and e-commerce experiences. You can directly support the fundamentals of your investment by buying products from the company, incentivized by a nice voucher or coupon code.

Gift Cards

Gift cards may also be offered to shareholders who buy and hold stock in publicly traded companies.

Discounts on Specific Products

Many companies with shareholder perks offer discounts on specific products. For example, several hospitality groups that trade on the LSE offer shareholders discounts on meals at their restaurants.

Aterian, an American company that manufactures many products on Amazon sends out discounts for specific products that they manufacture every single Friday.

Japan Airlines offers 50% off flights to shareholders who own over 100 shares (and have a primary residence in Japan), and you can gift these discounts (eligible for 1 way flights) to anybody.

Loyalty Status

If you own shares in some companies with existing loyalty programs, you may be able to automatically get status in their loyalty programs.

Loyalty Status Tiers are popular with airlines and hotels.

For example, there are several live shareholder rewards programs where you can earn status if you own a minimum share quantity.

SAS Airlines is perhaps the most popular company offering this type of reward. You can redeem discounted flights if you own over 4,000 shares. For 100,000+ shares you'll get EuroBonus Gold status. And for 1,000,000+ shares, you'll get EuroBonus Diamond.

EuroBonus Diamond comes with serious benefits like free lounge access, complimentary beverages, deep discounts, flight upgrades and more.

Loyalty Points

Instead of status, a shareholder reward may come in the form of loyalty points. Many companies have a loyalty program, where you earn points when purchasing consistently.

By being a shareholder of a company with a loyalty program, you may be eligible for free rewards points.

Credit For In Person Experiences

If a company puts on in person experiences, you can sometimes get credit/discounts on tickets, drinks, and other exclusive perks at the event.

Exclusive Access

You may also be able to get exclusive access to company facilities and events as a shareholder.

Sometimes this is in the form of VIP or special tickets to events, launch announcements, concerts and more.

Other companies offer in person tours of factories and facilities to individual retail investors.

If you're a member of the LVMH shareholder club you can visit properties, facilities, and factories owned by the company.

Meetings With Executives

Public companies want to engage with retail investors to better understand their needs. Retail investors want insight into the executives who operate the companies in which they invest.

Some companies offer qualified shareholders exclusive 1 on 1 or group meetings with Executives, which benefit all parties involved.

In the past, Tesla has invited individual investors to submit and vote on questions that would be covered during earnings calls.

Shareholder Swag/Merch

Some companies offer shareholder swag to investors, in the form of shirts, stickers and other items that you can use to rep your investments.

Conclusion

The world of shareholder rewards is exciting, and for retail investors, the redemptions are even better.

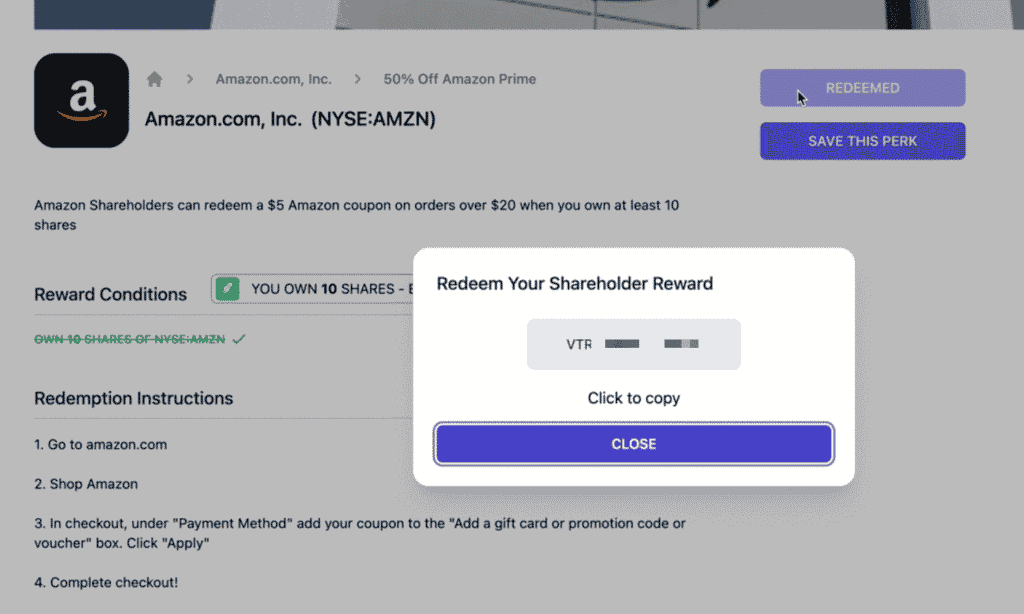

There are many different types of shareholder rewards. ShareClub offers a platform that makes it easy to validate that you meet conditions for shareholder rewards and redeem your perks.

.png)